Colombia

Colombia The fastest-growing digital country in Latin America

Offer customized solutions for Colombia.

A market of connectivity and innovation

Colombia is advancing in Open Banking, adopting instant payment methods, and opening companies and businesses.

US$ 0,73 Bi

Estimated revenue until 2027

[source: Statista]

46,3 %

Of the population made

sports bets last year

1,2 M

Colombian users

forecast until 2027

Sell in Colombia the smarter, faster way

Local support 24/7

Talk directly with our team anytimeSecurity

Transactions protected with SSL, encryption, and real-time fraud checksBoost your conversion rate

Smart routing helps your users pay faster and without friction

Discover Colombia's payment methods

PSE: Secure Online Payments

PSE is Colombia's leading online payment method: fast, secure, and widely trusted.

Receive instant payment confirmation directly from the bank.

Accept payments from any Colombian bank: no card required.

Available at major Colombian banks

Bank Transfer: Reliable payments for your business

Traditional transfers, simplified

Receive payments directly to your bank account from any Colombian financial institution.

Ideal for merchants and companies preferring manual bank transfers.

Fast settlements and lower operational costs.

Compatible with both individual and corporate bank accounts.

Available at major Colombian banks

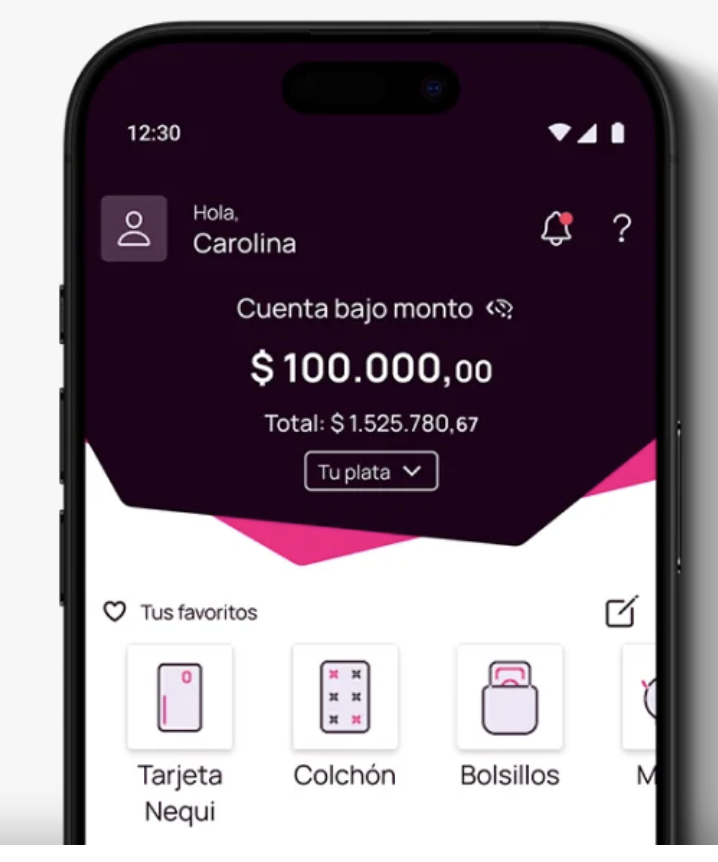

Nequi: Colombia’s Leading Digital Wallet

Instant, secure, and mobile-friendly payments

A 100% digital financial app that lets users pay, save, and manage money with ease.

Over 18 million users across Colombia the most popular digital wallet in the country.

Accept payments instantly via QR code, bank transfer, or wallet-to-wallet.

Ideal for mobile-first customers and eCommerce platforms.

Cash Payments: Easy and Accessible Across Colombia

Pay in cash, anywhere, anytime

Accept cash payments instantly through Efecty, Colombia’s largest cash network.

Available in over 9,000 service points nationwide — from major cities to rural areas.

Payments are processed in Colombian pesos (COP) with instant confirmation.

Ideal for users without a bank account or credit card.

Offer local payment methods and increase your conversion rate in Colombia

Explore the Brazilian market

From PIX to Boleto, we cover all territories of Brazil and offer the most used payment methods by Brazilians.

What does SmartFastPay do?

SmartFastPay Technology and Services is a Brazilian company that offers local payment methods for national or international websites. We process payments in local currency or market-specific solutions. To use our services, you must be registered on the partner Sites to whom we offer the services.

As SmartFastPay is a payment and technology company, we do not have the autonomy to cancel and/or decide any internal processes of our partners. Therefore, all information about delivery, tracking, refunds, and other details of your purchase should be requested directly from your shopping site.

How long does it take to confirm my payment?

The payment processing time may vary according to the payment method used.

We do not have autonomy over the processing time since we depend on the settlement/confirmation of the bank. When we receive the payment confirmation from the bank, the transaction is automatically approved, and the credit is sent to the purchase site.

If the indicated processing time has exceeded the expected period, we ask that you contact the purchase site sending the payment voucher.

- PIX: Instantaneous or up to 11 minutes

- Traditional Boleto: Between 24h to 72h

- Credit Card: Instantaneous

- Debit Card: Instantaneous

- TED Bank Transfer: If made within business hours, TED transfers can take up to 2 hours to be identified by the receiving bank and compensated in your contact's account. However, if transfers are made outside business hours or on weekends, they will be scheduled for the next business day.

- DOC Bank Transfer: an option for transfers from one bank to another, when performed until 9:59 PM on a business day, the operation is compensated on the next business day. After this time and on weekends and holidays, the credit only occurs on the second business day.